Understanding the Importance of Business Credit Builder Accounts

Building a strong credit profile is crucial for any business, big or small. One key tool that can help businesses establish and improve their credit scores is a Business Credit Builder program. In this article, we will delve deeper into the world of business credit builder accounts, their benefits, and how they can help your business thrive.

The Benefits of Business Credit Builder

Business Credit Builder accounts offer a range of benefits that can positively impact your business’s financial health. Some of the key advantages include:

- Improved Credit Score: By establishing a good credit history with a business credit builder card or loans, you can enhance your business’s credit score.

- Access to Funding: Having a strong credit profile opens up doors to better funding options and higher loan amounts.

- Enhanced Credibility: A solid credit history signals to lenders, suppliers, and partners that your business is reliable and trustworthy.

- Lower Interest Rates: With a good credit score, you are likely to qualify for loans and credit cards with lower interest rates, saving your business money in the long run.

Detailed Explanation of Business Credit Builder

A BUSINESS CREDIT BUILDER program is designed to help businesses establish and grow their credit profiles. These programs typically offer services such as setting up business credit accounts, securing business credit tradelines, and providing credit building services tailored to the specific needs of each business.

BUSINESS CREDIT BUILDER companies specialize in assisting businesses in navigating the complex world of credit building. They work with you to develop a customized strategy to improve your business credit scores, leveraging tools like business credit cards, loans, and tradelines to achieve your financial goals.

Frequently Asked Questions about Business Credit Builder

- What is a Business Credit Builder program?

- How does a Business Credit Builder card differ from a personal credit card?

- Can a business credit builder program guarantee a certain credit score increase?

- Are Business Credit Builder loans difficult to qualify for?

- How do I choose the right Business Credit Builder company for my business?

A business credit builder program is a service offered by specialized companies to help businesses establish and improve their credit profiles through various strategies and tools.

A BUSINESS CREDIT BUILDER card is specifically geared towards business expenses and helps separate personal and business finances, while a personal credit card is intended for individual use.

While a BUSINESS CREDIT BUILDER program can significantly boost your credit score, the exact increase is dependent on various factors such as your business’s credit history and financial management.

Business Credit Builder loans are designed to be more accessible for businesses looking to build their credit, making them a viable option for businesses at various stages of development.

When selecting a Business Credit Builder company, consider factors such as their experience, track record, and the tailored services they offer to ensure they align with your business’s needs.

Conclusion

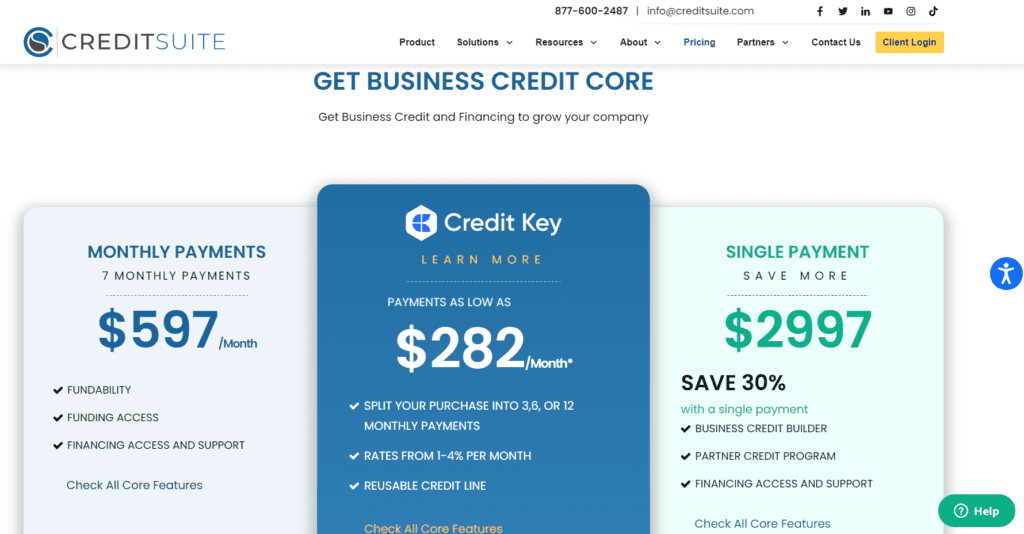

Business Credit Builder programs are invaluable tools for businesses aiming to establish strong credit profiles and secure better financing options. By leveraging these programs, you can unlock a world of opportunities to grow your business and enhance its financial stability. If you are considering exploring Business Credit Builder services, take the time to research reputable companies and evaluate the services they offer to find the best fit for your business’s needs.