Unlocking Opportunities with Business Credit Builder

When it comes to establishing and growing a successful business, having access to financial resources is crucial. For many entrepreneurs and small business owners, securing funding through traditional means can be a challenging task. This is where Business Credit Builder comes into the picture as a valuable tool to help businesses build their creditworthiness and access the capital they need to thrive.

The Benefits of BUSINESS CREDIT BUILDER

Business Credit Builder offers a range of benefits for business owners looking to establish or improve their credit profiles. Some of the key advantages include:

- Access to business credit builder accounts to separate personal and business finances.

- Opportunity to obtain a business credit builder card to make purchases and build credit.

- Participation in a business credit builder program that helps in building a strong credit history.

- Potential for securing business credit builder loans for expansion and growth.

- Collaboration with reputable business credit builder companies to navigate the process effectively.

- Utilizing business credit builder tradelines to enhance credit scores.

- Access to professional business credit building services tailored to individual business needs.

- Gaining insights and guidance through business credit builders reviews to make informed decisions.

A Detailed Explanation of Business Credit Builder

Business Credit Builder is a systematic approach to establishing and improving a business’s credit profile. By utilizing various financial products and services specifically designed for businesses, entrepreneurs can lay the foundation for a strong credit history. Through the establishment of BUSINESS CREDIT BUILDER accounts and the responsible use of a business credit builder card, businesses can demonstrate their creditworthiness to lenders and creditors.

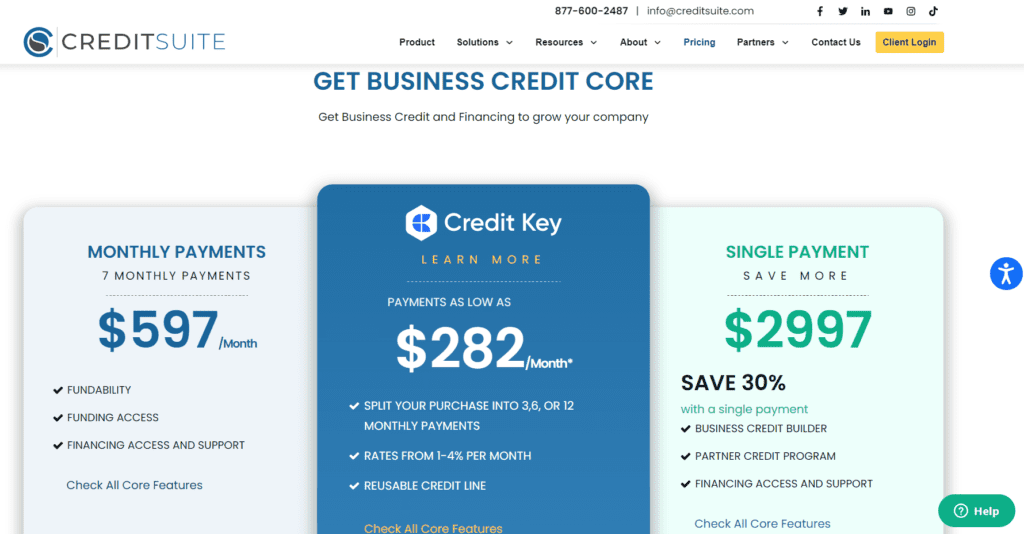

Moreover, enrolling in a business credit builder program provides businesses with the guidance and support needed to navigate the complexities of credit building. From accessing business credit builder loans to leveraging business credit builder tradelines, the program equips business owners with the tools to enhance their credit scores and unlock new opportunities for growth.

Frequently Asked Questions about Business Credit Builder

- What are the key benefits of utilizing business credit builder services?

- How can business credit builder accounts help in separating personal and business finances?

- Is it necessary to have a business credit builder card to build credit?

- What factors should I consider when choosing a business credit builder program?

- Can business credit builder loans help in expanding my business?

Conclusion

In conclusion, BUSINESS CREDIT BUILDER offers a strategic approach for businesses to establish and strengthen their credit profiles. By leveraging the various tools and services available through business credit building programs, entrepreneurs can position their businesses for long-term success and growth. Whether it’s accessing business credit builder loans or collaborating with reputable companies in the industry, the opportunities that Business Credit Builder provides can make a significant difference in the financial health of a business.